Tax and Accounting Services

Welcome to our Tax and Accounting Services page. Please scroll down to view the services that we offer. Please contact us if you do not see what you are looking for so we can let you know how we can help you in finding what you need quickly.

We look forward to helping you!

Tax Services

• Individual Income Tax Return Preparation and Tax Return Filing (E-file available)

We will file your individual tax return along with all forms and schedules required in your tax return. Once complete we will electronically file your federal and state tax return if required. We can help you with filing your Form 1040 or Form 1040 -SR along with preparing your Schedule A (for Itemized Deductions), Schedule B (for Interest and Dividends), Schedule C (for Sole Proprietor), Schedule D (for Capital Assets Sold), Schedule E (for Rentals), Schedule F (for Farmers), and Schedule H (for Household Employers). Along with other forms required for EIC (Earned Income Credit), Child Tax Credit, Dependent Care Credit and the Premium Tax Credit. Along with assisting you on making sure your return has the required ACA (Affordable Care Act) provisions reported on you tax return.

• Partnership Tax Return Preparation and Tax Return Filing (E-file available)

We will file your partnership tax return along with all forms and schedules required in your tax return. Once complete we will electronically file your federal and state tax return if required. We can help your with your Form 1065 along with the required schedules for your tax tax return.

• S Corporation Tax Return Preparation and Tax Return Filing (E-file available)

We will file your S Corporation tax return along with all forms and schedules required in your tax return. Once complete we will electronically file your federal and state tax return if required. We can help your with your Form 1120S along with the required schedules for your tax tax return.

• C Corporation Tax Return Preparation and Tax Return Filing (E-file available)

We will file your C Corporation tax return along with all forms and schedules required in your tax return. Once complete we will electronically file your federal and state tax return if required. We can help your with your Form 1120 along with the required schedules for your tax tax return.

• Nonprofit Tax Return Preparation and Tax Return Filing (E-file available)

We will file your Nonprofit (Tax Exempt) tax return along with all forms and schedules required in your tax return. Once complete we will electronically file your federal and state tax return if required. We can help you with Form 990, Form 990EZ, Form 990N, and Form 990T along with the required schedules for your tax return.

• Payroll Tax Return Preparation and Tax Return Filing (E-file available)

We will file your payroll tax returns along with all forms and schedules required in your tax return. We can help you with your Form 941, Form 940, Form W-2, Form 1099 returns, along with any state forms that are required. If you need help in preparing your payroll we can help you with this too!

Accounting Services

• Complete Accounting Service

We can assist you in getting your accounting records caught up, straightened up, and keep you current. We can help you with general bookkeeping or preparing the your company statements to assist you in managing your company’s accounting.

• QuickBooks Services

We can help you with getting your company QuickBooks file set up, company file cleaned up, or maintain your current records properly in QuickBooks.

• Payroll Services

We can help you set up or keep you current on all your company payroll requirements. We can do weekly, bi-weekly, semi-monthly, or monthly payrolls for your company.

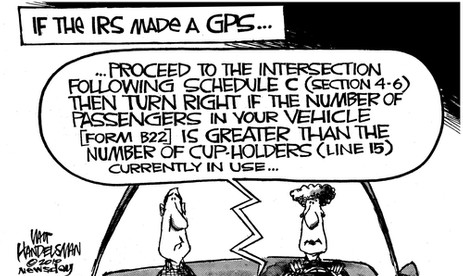

Don’t get lost … we can help make sense of the tax laws for you!